There has been a run of particularly good data regarding the state of the NZ economy recently which calls into question the expectation many people have of interest rates remaining at record lows for many years and bespeaks of NZD appreciation.

In the labour market the creation of 17,000 jobs during the December quarter has contributed to a fall in the unemployment rate to just 4.9%. This is down from 5.3% in September, up from about 4.1% a year earlier, and less than half the rate many were predicting when the country was in lockdown over March through May last year.

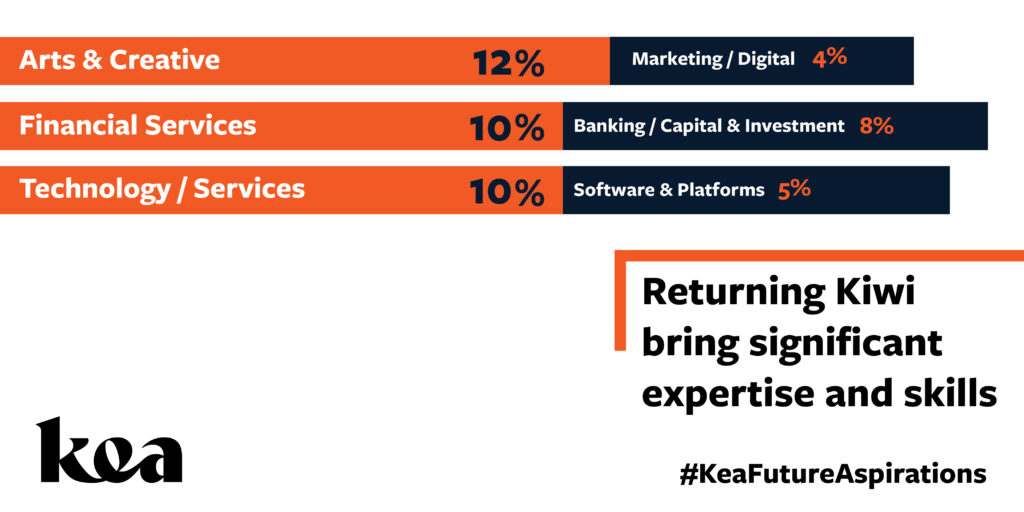

This strong performance partly reflects a shortage of migrant workers unable to get into the country with some leaving as their visas have expired. But it mainly reflects strength across a range of sectors in the economy.

The public sector and health in particular are strong, and construction is on a strong growth track with job numbers ahead over 8% from a year earlier.

In the construction sector prospects for further growth are firm with the number of consents issued for the construction of new dwellings rising to a 45-year high in 2020 just shy of 40,000. Builders have buyers screaming for properties not so much because of the phenomenon offshore of people wanting to escape the cities or at least get a place with a backyard. Instead, there simply are not enough used houses being listed on the market to satisfy skyrocketing demand.

The number of properties sold around New Zealand was 33% ahead of a year earlier in the June quarter. But the number of properties listed was down 26% from the year before, and 73% from ten years ago. A shortage of listings amidst a surge in people wanting to buy something – literally anything – is proving a boon for the house building sector and the many industries which feed into it and off of it.

In the monthly REINZ & Tony Alexander Real Estate Survey this month a net 90% of agents said that they are seeing FOMO – fear of missing out – on the part of buyers. A net 92% say that prices are rising in their area and the data show that over the last four months of 2020 average house prices in New Zealand rose by 11.7%. Never before have house prices in New Zealand risen by such a percentage over a four-month period.

The scramble for property by investors has caused some banks to leap ahead of potential policy changes by the somewhat sleepy Reserve Bank and impose a 40% minimum deposit requirement for investors seeking a mortgage. Not all banks are yet demanding this, but it is becoming the de facto standard.

The only real question is whether minimum deposits will move to 50%. There is a chance they do because although the last time 40% deposits were implemented (in 2016) house price inflation in Auckland stopped whilst it halved elsewhere, this time things are different.

Back then in 2016 the average mortgage rate was around 4.5% rather than the current 2.5%. The average deposit rate was 3.3% and not 0.8%. Auckland had been on a four-year tear and was due to take a break. And one more thing.

My monthly Tony’s View Spending Plans Survey tells us that over the past few months the age group of people showing the greatest lift in intentions of buying an investment property has been those aged 51-65. These are people who have retirement returns and retirement wealth more at the forefront of their minds than the age group below them of 30-49.

They are the group most likely to have minimal or no mortgage and some savings. Their desperation to buy means a 40% deposit requirement may not prove the barrier it was back in 2016.

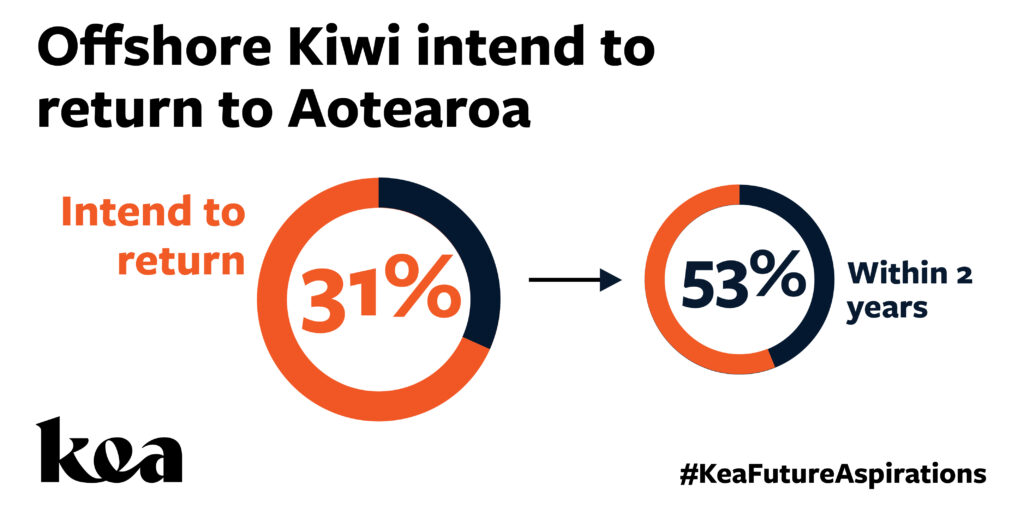

So, for New Zealand, the labour and housing markets are strong, we can see rising consumer confidence and strong plans to boost spending. Business confidence is strong and investment intentions firm, and wealth is rising from escalating house prices. Dairy payouts are even going up. With a central bank wary of signalling higher interest rates because of the upward impact this would have on the NZ dollar, growth in the NZ economy looks likely to be strong this year and accelerating into 2022 – especially with an eventual reopening of the borders then (fingers crossed) and anticipated much larger flood of people coming in.

If you want much more information on the NZ economy and housing market in particular you can sign up for my free Tony’s View weekly at www.tonyalexander.nz

HOW KEA CAN HELP

Join

Join the Kea community, and stay connected to New Zealand, its people and businesses wherever you are in the world.

Kea Connect

Help Kiwi businesses explore their global potential through our worldwide community.

MENU

MENU