The report builds on Kea’s Welcome Home survey released in November last year when we sought to understand the timeframes, skills, industry experience as well as needs – of our returning Kiwi.

With the world continuing to evolve and adapt to the Covid-era, we saw the need to reconnect with our Kea community – to understand how the last 6-12 months have affected them, and how that could be impacting their decisions for the future. We wanted to understand what’s changed for offshore and returning Kiwi? How can Aotearoa make the most of this moment in time?

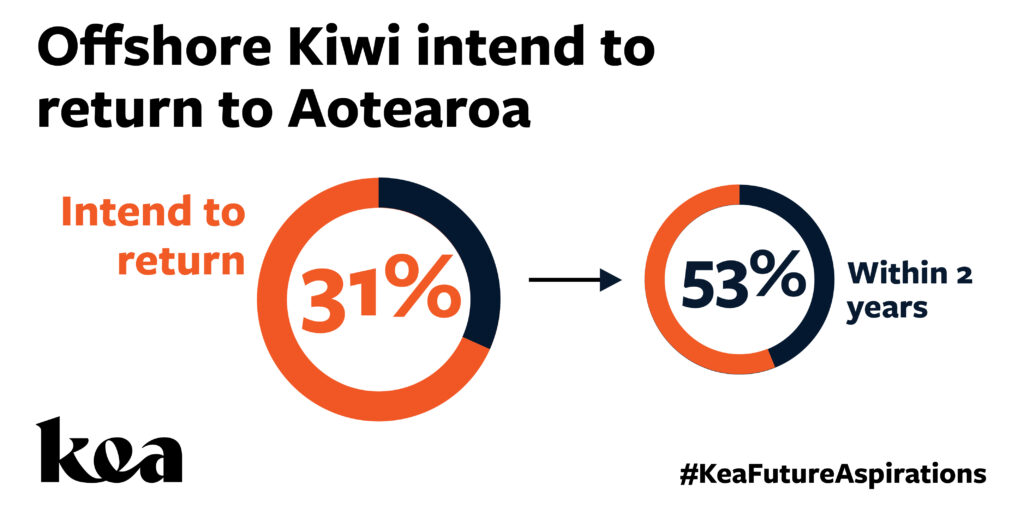

We continue to see strong intentions of our offshore Kiwi planning to return to Aotearoa.

Of those intending to return, 69% intend to do so permanently. Returning Kiwi are wanting to develop their roots in Aotearoa and invest.

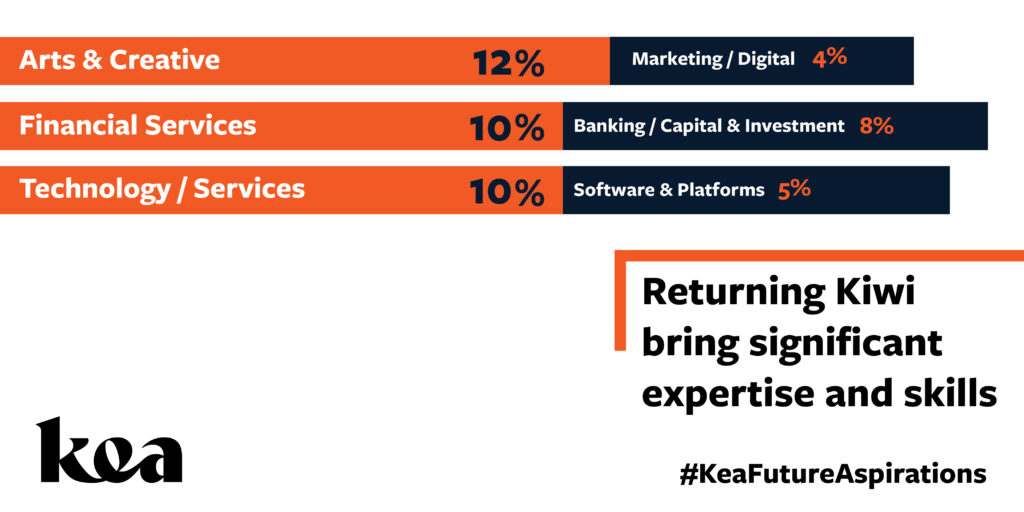

While their choice to return is primarily lifestyle-driven, our returning Kiwi bring significant expertise and skills. 40% of people who have Senior, Director, VP, C-suite or Board experience, indicated they have 10+ years experience in this space.

While many Kiwi choose to remain abroad, their connection to home and willingness to contribute remains

Now is the time to act to unlock the potential of our exploring Kiwi.

Click here to access the full #KeaFutureAspirations report

If you’d like to enlist the ideas and experience of our offshore and returning Kiwi to support your business, please get in touch and let’s engage our global explorers.

MENU

MENU